- The case for a housing market crashby John Rapley

Although today’s article in the Globe and Mail might not make me popular in my native land, I think a housing crash might not be such a bad idea for Canada – and indeed most anywhere for that matter.

It was a big mistake to ever sell housing as a good investment. First off, it rarely is. Plot the long-term returns of property and stocks in the world’s most dynamic economies and you’ll see that it’s almost always a laggard (as the one percent know all too well, which is why they seldom put much of their portfolio into real estate).

Secondly, where it is the best investment you can make, as it was in Canada over the last few years, it’s because the rest of the economy has been so anaemic. That’s not accidental. The anaemic economy is, in part, due to the housing bubble. Let’s always remember that whatever incomes they create for estate agents, builders and owners who cash in their capital gains, houses themselves produce nothing. They add nothing to the economy and do all but nothing to raise labour productivity (in which Canada is now a star underperformer).

But when government and central-bank policies incentivise investment in real estate, investment gets diverted from productive activities. A bank that might hesitate to lend you money to start a business won’t blink an eye at giving you the money to buy something which sits idle. Meanwhile owners grow rich while the young workers struggling to get onto the property-ladder are forced to pay inflated rents to a class which is doing little to energise the economy.

Let it crash, I say. Let government policies protect those most vulnerable in a property crash, but let young people get back on the property ladder once more and let investment look for new opportunities in things that will really improve the world (like the energy transition).

Read the full article here.

- John Rapley on Cyril Ramaphosa’s last chanceby John Rapley

On December 13, South Africa’s embattled president, Cyril Ramaphosa, survived a vote in Parliament on whether to impeach him over misconduct allegations. Less than a week later, on December 19, he won a second term as head of the ruling African National Congress (ANC). It was a remarkable turn of fortunes for a leader who, a month earlier, in the wake of a lurid scandal involving a cash-stuffed sofa, appeared to be confronting the end of his presidency. But Ramaphosa now faces the challenge of his political career. Though the recent ANC leadership race exposed, once again, the fragility of Ramaphosa’s grip on his party, his ultimate success in that race may finally have given him the mandate he needs to tackle the deep-rooted corruption that is eroding the state and strangling the economy. But it is also possible, as his critics allege, that with or without the authority to tackle the problem, Ramaphosa lacks the will. South Africans are about to find out.

In 2017, Ramaphosa seized the presidency of the ANC and subsequently became president of the country, casting himself as the savior who would rescue South Africa from the catastrophic plunder—or “state capture,” as everyone took to calling it—that occurred under the administration of his predecessor as president, Jacob Zuma, who had served in the role since 2009. But five years into a presidency that has yielded insufficient progress on corruption, Ramaphosa finds himself mired in a crisis of his own making. Amid crippling factional battles in the ANC, the government’s popularity has collapsed, and voter surveys suggest that it is likely to lose South Africa’s next general election, in 2024. With a fragmented opposition that has, to date, struggled to produce a credible candidate, the country appears headed for chaos.

It is all so far from the dreamlike optimism of that May morning in 1994 at Nelson Mandela’s presidential inauguration when the former freedom fighter and political prisoner was saluted by the country’s military, a gesture that came to be viewed as the ultimate symbol of a racist regime’s submission to the democratic will. Even if it was largely fiction, South Africans’ image of themselves as a rainbow nation uniting in a new destiny endured through the Zuma presidency. But the notion of Ramaphosa as the good knight who would rescue a troubled country always strained credulity. South Africa’s problems run far deeper than the state capture of the Zuma years, which were just a symptom of the disease.For more, read John Rapley’s analysis of South Africa’s current crisis, in today’s Foreign Affairs.

https://www.foreignaffairs.com/south-africa/ramaphosas-last-chance

- We’ll never get back to low inflation, and we shouldn’t even tryby John Rapley

In a column published yesterday in the Globe and Mail, I argue that the low price rises of the past three decades were achieved on the back of globalization and the cheap labour it made available. That trend is now reversing, and that is largely a good thing.

This week’s U.S. and British inflation reports continued recent trends across Western countries, with inflation pulling back from recent highs. Next week’s Canadian figures will probably bring similar holiday cheer. Thrilled that central banks appear to be winning the war on inflation, investors have started their celebrations early, launching year-end rallies in stock markets and driving bond rates down.

But while the news is unquestionably good, those celebrations may be premature. There’s a sting coming in inflation’s tail, and you can spot it in the bowels of the figures.

The column builds on our recent research brief on inflation, which you can download here.

- When it comes to China and Taiwan, the West should take a page out of its Ukraine playbook – don’t fight, but provide armsby John Rapley

The game-theorists are furiously at work, mapping out decision-trees to assess what might happen if China invades Taiwan. Tension is rising. As Xi Jinping’s rhetoric grows bellicose, he gives every indication he’ll define his tenure by the reintegration, if needed by force, of the renegade province into the rest of China. But after more than seven decades of separation from China, and its evolution into a vibrant liberal democracy, Taiwan wants to set its own course. Thirty years ago most Taiwanese identified with China. Today, the longing for reunification is confined mostly to older people. As it distances itself from Beijing, the government in Taipei has been deepening ties to the United States-led alliance, which includes not only its NATO partners but regional powers like Japan, Australia and India. But talk of a confrontation between China and the West presumes the two sides will come to blows. What if the alliance instead used the approach it has employed rather effectively in Ukraine? What if it made it clear it would stand aside during the fighting, but give Taiwan all the weaponry and support it needed to defend itself?

See my column in today’s Globe and Mail, where I make a case for Western countries arming Taiwan but not fighting for it.

- The new global inflation regimeby John Rapley

Early in November, the monthly inflation report from the US Bureau of Labor Standards took markets by surprise. Not only had the inflation rate in the American economy fallen more than expected, but the underlying core rate fell even more. As the stock market surged and bond yields plunged, the leading lights of the economics profession declared inflation all but dead.

Their confidence that inflation has now peaked and will steadily return to earth reflects a widespread agreement among economists that inflation is demand-driven, and that what caused the inflation spike was the Biden administration’s excessively-generous fiscal stimulus (which had added to the already-generous pandemic assistance provided by the Trump administration). Because the economy was already opening, it was said that too much money entered at once, causing demand to run well ahead of supply. The solution was to curb demand. That would be done with monetary policy – the sharp tightening cycle begun by the Federal Reserve. The sharp turn that happened last month was thus attributed to the successful effect of monetary tightening, rapid rises in credit costs having evidently begun to rein in spending sufficiently to bring inflation back under control.

But there’s a problem with this thesis. For starters, it doesn’t explain why inflation rose less in the US than it did in Europe, even though the increase in aggregate demand was much greater in the American economy. Second, it neglects a significant development that had begun to happen in labour markets about ten years ago: costs began rising, and there was evidence this inflationary pressure began broadening out, but it was largely overlooked by central banks because consumer prices still remained tame. But sooner or later, if an exogenous shock tipped the fragile demand-supply equation out of balance, inflation could surge.

Such an exogenous shock occurred during the pandemic. Since the interruption of supply was only going to be temporary, a demand-driven model of inflation would reasonably conclude any inflation which resulted would be transitory – and that is in fact what central banks did, leading hem to keep monetary policy loose despite the rise in prices. But we anticipated, correctly, that inflation would not prove transitory. We then decided to engage in a novel experiment to test our hypothesis. Rather than focus only on the demand-side, we decided to investigate what was happening on the supply-side as well – and in particular, the supply of labour. What we found was very interesting.

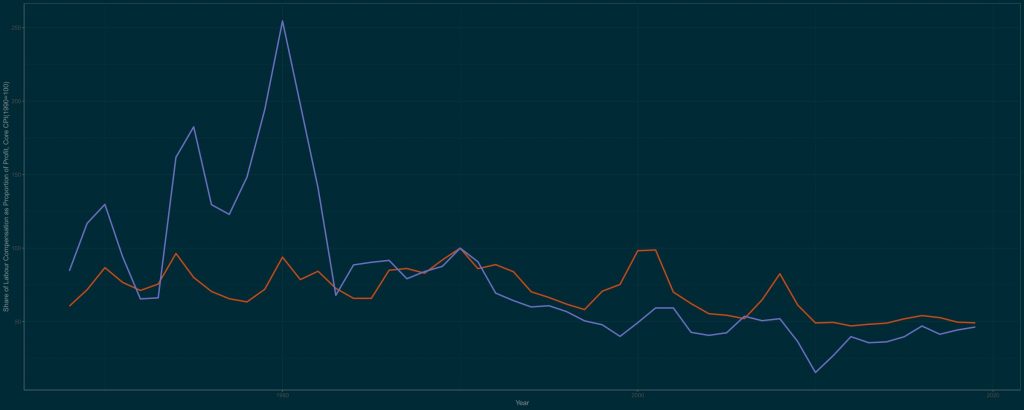

The graph which follows plots core inflation (blue) against a measure of labour’s bargaining-power (a ratio of wages to profit, with a rise indicating workers grabbing a bigger share of output). What it reveals is that after decades of steadiness, the relative position of labour in 1990 began a long slide. So did inflation. This, of course, was ‘the Great Moderation’, the era of booming stock markets and low prices – secured at the expense of workers, whose real wages remained flat.

But in the last decade, as revealed, the red curve stopped declining. After decades of relative weakness, workers began gaining more bargaining-power. That has now shown up in the persistently strong labour market, with rising wages, amid a tightening cycle which is compressing profits and knocking down asset-values.

We will shortly produce a white-paper which builds upon these findings and assesses their implications. The long and short of it is that while inflation will continue falling, it won’t fall as much as markets currently expect, and will likely stay permanently higher than the 2-3% expected by central banks. Apart from the fact that a reckoning is likely to come for markets once the new reality sinks in, this development will have profound implications throughout the economy for years, if not decades, to come. We will explore these at length, so watch this space!

UPDATE: The white-paper can now be downloaded here.