Early in November, the monthly inflation report from the US Bureau of Labor Standards took markets by surprise. Not only had the inflation rate in the American economy fallen more than expected, but the underlying core rate fell even more. As the stock market surged and bond yields plunged, the leading lights of the economics profession declared inflation all but dead.

Their confidence that inflation has now peaked and will steadily return to earth reflects a widespread agreement among economists that inflation is demand-driven, and that what caused the inflation spike was the Biden administration’s excessively-generous fiscal stimulus (which had added to the already-generous pandemic assistance provided by the Trump administration). Because the economy was already opening, it was said that too much money entered at once, causing demand to run well ahead of supply. The solution was to curb demand. That would be done with monetary policy – the sharp tightening cycle begun by the Federal Reserve. The sharp turn that happened last month was thus attributed to the successful effect of monetary tightening, rapid rises in credit costs having evidently begun to rein in spending sufficiently to bring inflation back under control.

But there’s a problem with this thesis. For starters, it doesn’t explain why inflation rose less in the US than it did in Europe, even though the increase in aggregate demand was much greater in the American economy. Second, it neglects a significant development that had begun to happen in labour markets about ten years ago: costs began rising, and there was evidence this inflationary pressure began broadening out, but it was largely overlooked by central banks because consumer prices still remained tame. But sooner or later, if an exogenous shock tipped the fragile demand-supply equation out of balance, inflation could surge.

Such an exogenous shock occurred during the pandemic. Since the interruption of supply was only going to be temporary, a demand-driven model of inflation would reasonably conclude any inflation which resulted would be transitory – and that is in fact what central banks did, leading hem to keep monetary policy loose despite the rise in prices. But we anticipated, correctly, that inflation would not prove transitory. We then decided to engage in a novel experiment to test our hypothesis. Rather than focus only on the demand-side, we decided to investigate what was happening on the supply-side as well – and in particular, the supply of labour. What we found was very interesting.

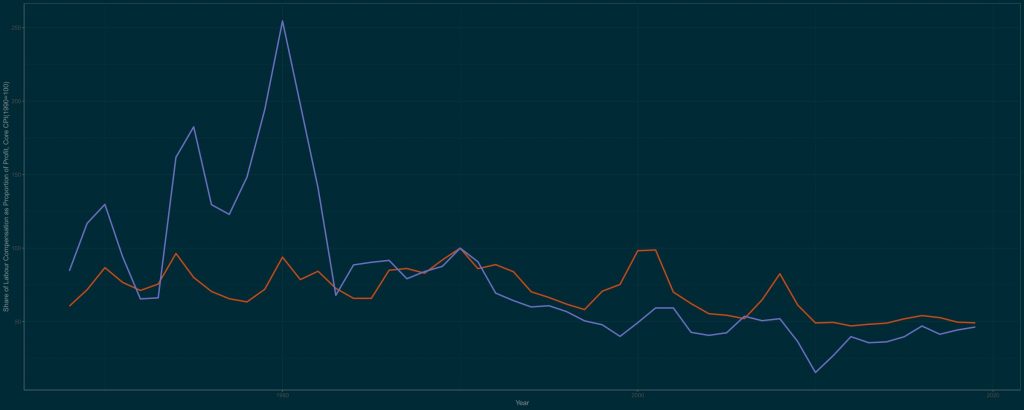

The graph which follows plots core inflation (blue) against a measure of labour’s bargaining-power (a ratio of wages to profit, with a rise indicating workers grabbing a bigger share of output). What it reveals is that after decades of steadiness, the relative position of labour in 1990 began a long slide. So did inflation. This, of course, was ‘the Great Moderation’, the era of booming stock markets and low prices – secured at the expense of workers, whose real wages remained flat.

But in the last decade, as revealed, the red curve stopped declining. After decades of relative weakness, workers began gaining more bargaining-power. That has now shown up in the persistently strong labour market, with rising wages, amid a tightening cycle which is compressing profits and knocking down asset-values.

We will shortly produce a white-paper which builds upon these findings and assesses their implications. The long and short of it is that while inflation will continue falling, it won’t fall as much as markets currently expect, and will likely stay permanently higher than the 2-3% expected by central banks. Apart from the fact that a reckoning is likely to come for markets once the new reality sinks in, this development will have profound implications throughout the economy for years, if not decades, to come. We will explore these at length, so watch this space!

UPDATE: The white-paper can now be downloaded here.